The Boston office market finished the first quarter of 2015 in an overall positive standing. It concluded the quarter with vacancy rates averaging at 9.1%, not a significant change from the previous quarter of 9.2%, however, vacancy rates have been consistently decreasing among all types of office spaces, i.e. Class A, Class b, and Class C, over the past several quarters.

Rental Rates — Class A: $27.33/SF Class B: $20.52/SF Class C: $17.48/SF

Boston’s office market saw a 2.6% increase in rental rates during the quarter, as the average rental price increased from $20.74 per square foot per year in 2014 Q4 to $21.27 per square foot per year in 2015 Q1. These higher rental rates are also met with higher delivery rates, as three buildings totaling 574,00 SF were delivered in Q1 compared to 235,000 SF delivered in the last quarter of 2014; a notable delivery of the recently closed quarter is 260 Longwood Ave, which is a 414,000 SF facility.

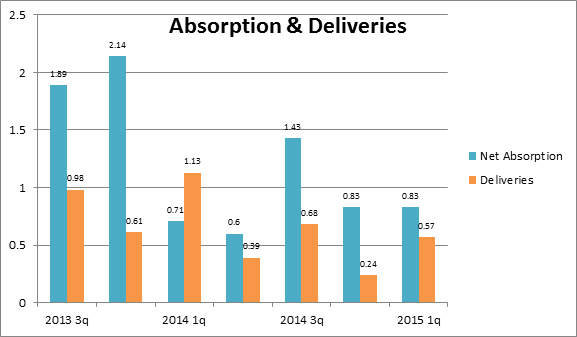

The net absorption for the market remains positive, at 825, 368 square feet; however that number is down from the two previous quarters of 833,152 SF and 1,434,811 SF in 2014 Q4 and 2014 Q3, respectively. Dana Farber absorbed the largest space of the quarter at 154,100 SF. Overall, the market saw lower absorption rates for Class A and Class C spaces, but a large increase in Class B; these rates average out to an overall positive absorption for Boston’s office market.

The largest lease signing of the quarter is held by GE Healthcare who leased a 208,101 SF space in the Route 495/Mass Pike West submarket. Shire Pharmaceuticals and Mass Innovation Labs held the following two highest lease signings of the quarter, suggesting the continual increase in Boston’s already exceptional health market.

The office market of Boston remains strong and overall saw many positives during the first quarter of the year; the vacancy rates are decreasing, the net absorption is positive, rental rates are increasing, and more spaces are being delivered. These facts support the notion that Boston’s office market is strong and has been doing well so far this year.

References:

-Costar

-New England Real Estate Journal

-The Boston Globe

-PR Newswire