The commercial real estate retail market has experienced minimal change in the first quarter of 2015. The retail market saw the vacancy rate held at 3.9%; vacancy rates are determined by a “percentage of the total amount of physically vacant space divided by the total amount of existing inventory.” The Boston retail market includes the Greater Boston Area, which encompasses submarket clusters ranging as far west as Worcester.

Focusing more specifically on the submarket clusters of Boston/Suffolk County and Cambridge, these two areas had the lowest vacancy rates of any other submarket cluster listed, with 2.0% and 2.5%, respectively. These low vacancy rates are contrasted with the submarket clusters of Route 495/Mass Pike West and Route 495/Route 2 West, which have the highest vacancy rates at 5.0% and 4.8%, respectively. It appears that the closer a retail space is to the city of Boston itself, the lower the vacancy rate is as well.

Currently in Boston, the rental rates have gone up, from an average of $16.88 per square foot to $17.11/SF; the data from the past 7 quarters, meaning from third quarter of 2013 until now, shows that as the average rental rate has gone up, the vacancy rates have gone down. This correlation between higher leasing prices and lower vacancy rates shows that leasers are trying harder than ever before to get the most out of their spaces and use it to their fullest potentials so as to drive revenues to remain in business.

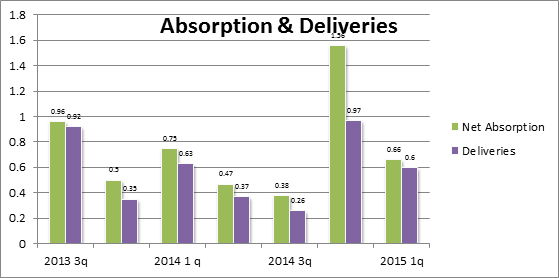

The retail absorption for quarter 1 of 2015 was moderate, at 661,993 SF, as compared to 1,564,306 SF of absorption in 4th quarter 2014, and 377,201 SF in the 3rd quarter of 2014. The largest lease singing of the quarter belongs to Whole Foods; they leased 40,000 SF of space on River Road. And, one of the most notable deliveries from the quarter was a 500,000 SF facility at 440 Washington Street.

In the Boston area, the vacancy rates have decreased from 4.1% to 3.9%, and based off the trends of the past quarters, it appears that the rate will continue to go down; the rental rates are going up, and the absorption rates remain moderate. The market is not seeing anything drastically new in the upcoming months, and because of that, businesses are booming, especially business that aid in quality of life-living, such as Whole Foods and Planet Fitness; the rise in health consciousness might be the reason that the retail market has been positively effected, but only time will tell.

References:

-Costar