02/08/2023 | by

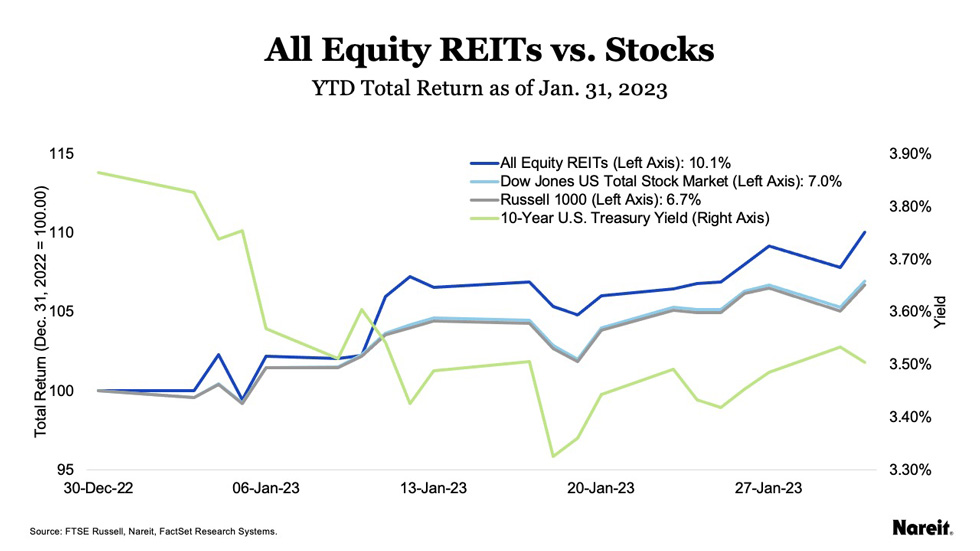

REITs posted their strongest returns since January 2019 and outperformed broader markets, as the FTSE Nareit All Equity REITs index rose 10.1% and the FTSE Nareit Equity REITs index gained 10.7%. Broader markets rose as well, as the Dow Jones U.S. Total Stock Market and Russell 1000 gained 7.0% and 6.7%, respectively. The optimism came as investors widely expect the Federal Reserve to pivot from its rate hiking cycle as the pace of inflation slows. REIT operational performance continues to be robust, as REITs reported a new all-time high of $19.9 billion in funds from operations in 2022: Q3, as laid out in Nareit’s T-Tracker . The yield on the 10-year Treasury fell 40 basis points from year-end to close the month at 3.5%.

Through the end of the month, total returns year-to-date were:

All Equity REITs: 10.1%

Russell 1000: 6.7%

Dow Jones U.S. Total Stock Market: 7.0%

All property sectors were positive in January, led by lodging/resorts at 17.1%, industrial at 13.7%, and data centers at 13.2%. Retail rose 7.4% and infrastructure was up 6.8%, as these laggard sectors rounded out a broadly positive month for REITs. Mortgage REITs performed strongly as well, with a total return of 15.7%. Home financing mREITs returned 15.5% and commercial financing mREITs returned 16.0% for the month.

Monthly Performance Summary

Global real estate markets performed strongly as well in January, with the FTSE EPRA Nareit Developed index posting a total return of 9.0%, compared to 7.3% for the FTSE Global All Cap.

Global Real Estate v Stocks

As shown in the chart above, Developed Europe led with a total return of 10.8%, followed by North America at 10.7% and Developed Asia at 3.7%.