Federal Reserve officials ramped up their battle against the fastest inflation in 40 years on Wednesday, ushering in a third straight supersize rate increase while projecting a more aggressive path ahead for monetary policy, one that would lift interest rates higher and keep them elevated longer.

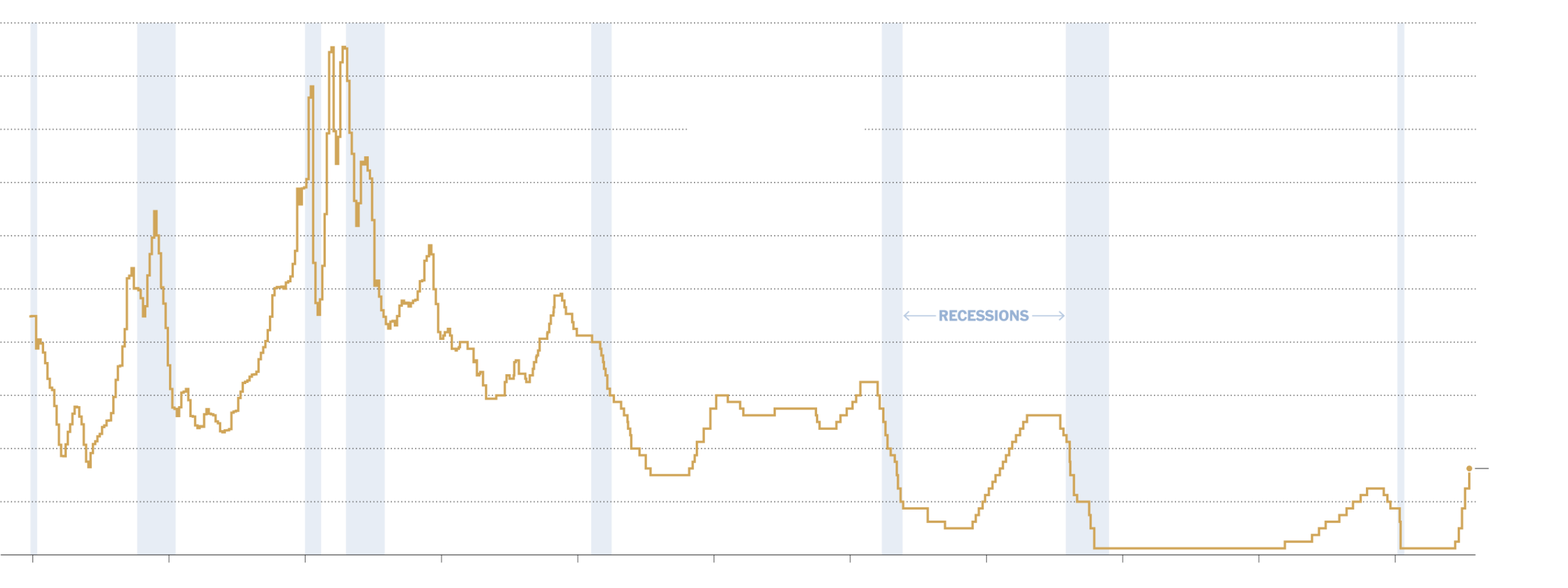

Central bankers raised their policy interest rate by three-quarters of a percentage point, boosting it to a range of 3 to 3.25 percent. The federal funds rate was set at near zero as recently as March, and the Fed’s increases since then have made for its fastest policy adjustment since the 1980s.

Even more notably, policymakers predicted on Wednesday that they will raise borrowing costs to 4.4 percent by the end of the year — suggesting that they could make another supersize rate move, followed by a half-point adjustment. Officials estimated that rates will climb to 4.6 percent by the end of 2023, up from an estimate of 3.8 percent in June, when they last published estimates.

Fed officials expect to begin lowering rates in 2024, but anticipate bringing them down only slowly.

The policy path that the Fed laid out on Wednesday was far more severe than the one officials had previously predicted. It shows the central bank pushing rates far past the point where they are weighing on economic growth and leaving them elevated for years to come.

Together, the Fed’s September rate decision and stark projections amounted to a declaration: The central bank is determined to crush inflation, even if doing so comes at a cost to the economy in the near term.

Jerome H. Powell, the Fed chair, will answer reporter questions at approximately 2:30 p.m., giving him a chance to explain the central bank’s new projections and likely reiterate the central bank’s commitment to wrangling rapid price increases with a decisive policy response.

Prices continue to increase at more than three times the rate central bankers target, making everyday life hard to afford for millions of Americans. While the jump in inflation has been global and comes partly because the pandemic and war have roiled supply lines, companies are able to charge so much partly because consumer demand has remained resilient. Officials are trying to change that.