Boston’s office market continues to face significant challenges as demand remains weak across key industries. The life sciences sector, once a major driver of leasing, remained quiet throughout 2024, and the tech, finance, and professional services sectors have paused large-scale commitments. This slowdown coincides with a wave of new construction, bringing an influx of office supply not seen in decades and intensifying competitive pressures across the metro.

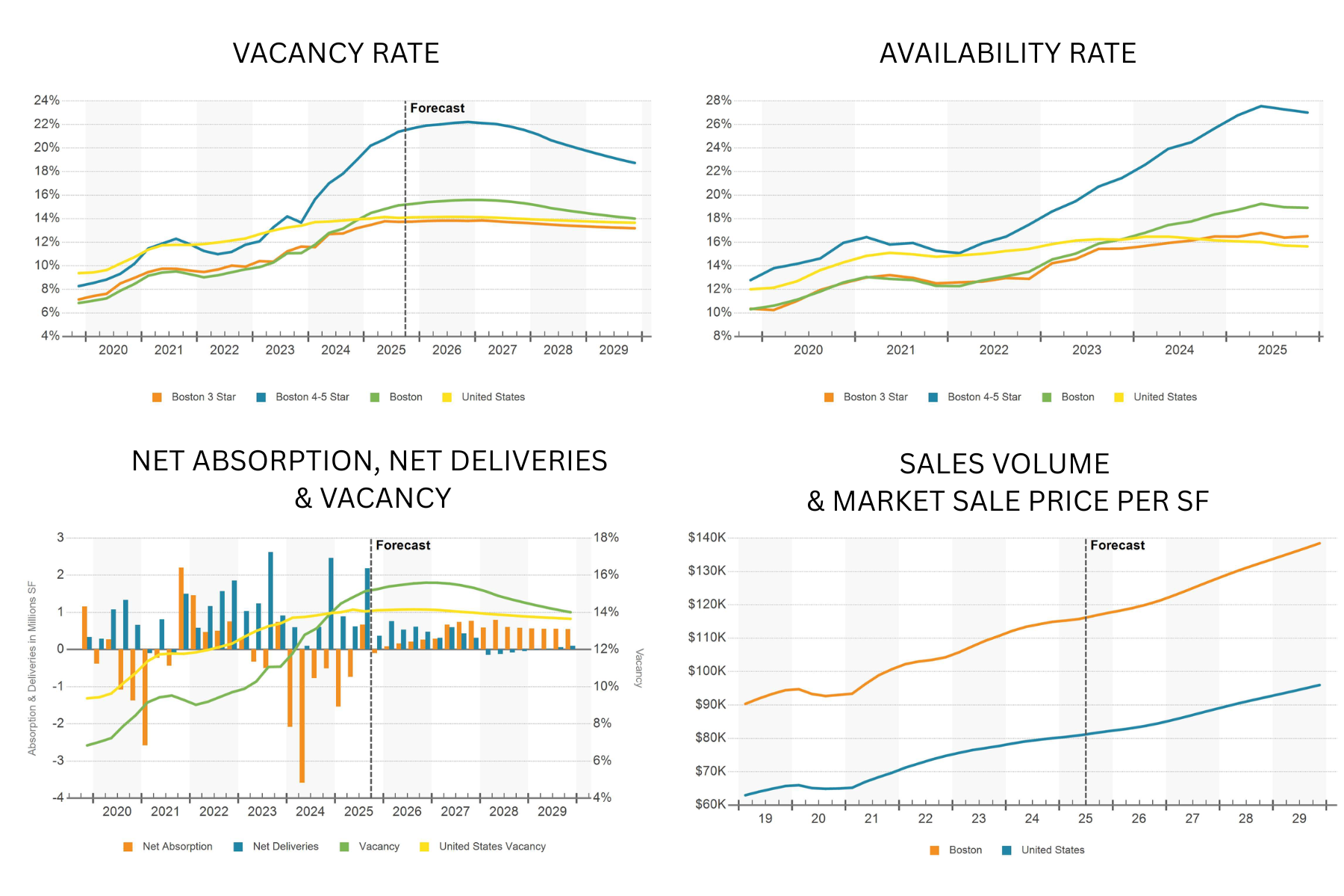

Vacancy has now reached a record 15.1 percent, closely tracking the national average of 14.1 percent. Boston had consistently outperformed the national vacancy rate for nearly two decades, but the gap has fully closed as vacancies more than doubled from the 6.7 percent level seen in 2019. Projections show Boston’s vacancy rate surpassing the national benchmark by mid 2025 as absorption struggles to keep pace with ongoing deliveries.

Office attendance has improved, with foot traffic data showing a ten point three percent year over year gain in midsummer, the strongest increase among major United States markets. Even so, attendance remains below the national average and has only reached 67.4 percent of pre-pandemic levels. This incomplete recovery has contributed to tenants returning a net -1.8 million square feet of space over the past year, marking the weakest absorption since 2001.

At the same time, more than seventeen million square feet of new supply has delivered within the past three years, with another 7.6 million square feet scheduled to arrive by 2026. Availability now exceeds eighteen percent, including over thirteen million square feet of sublease space. This oversupply, combined with subdued demand, continues to push the market into one of its most challenging periods in over twenty years.

Sales activity reflects these headwinds. Transaction volume in 2024 was the lowest in fifteen years, with only a few large trades occurring and most involving well-leased, high quality assets. While rate cuts have not yet restored liquidity, repricing among distressed properties is expected. Contact our team today to explore opportunities in this evolving office landscape and position your portfolio for long term success.