Boston Area Industrial Market Report for Q3 2025

Overview

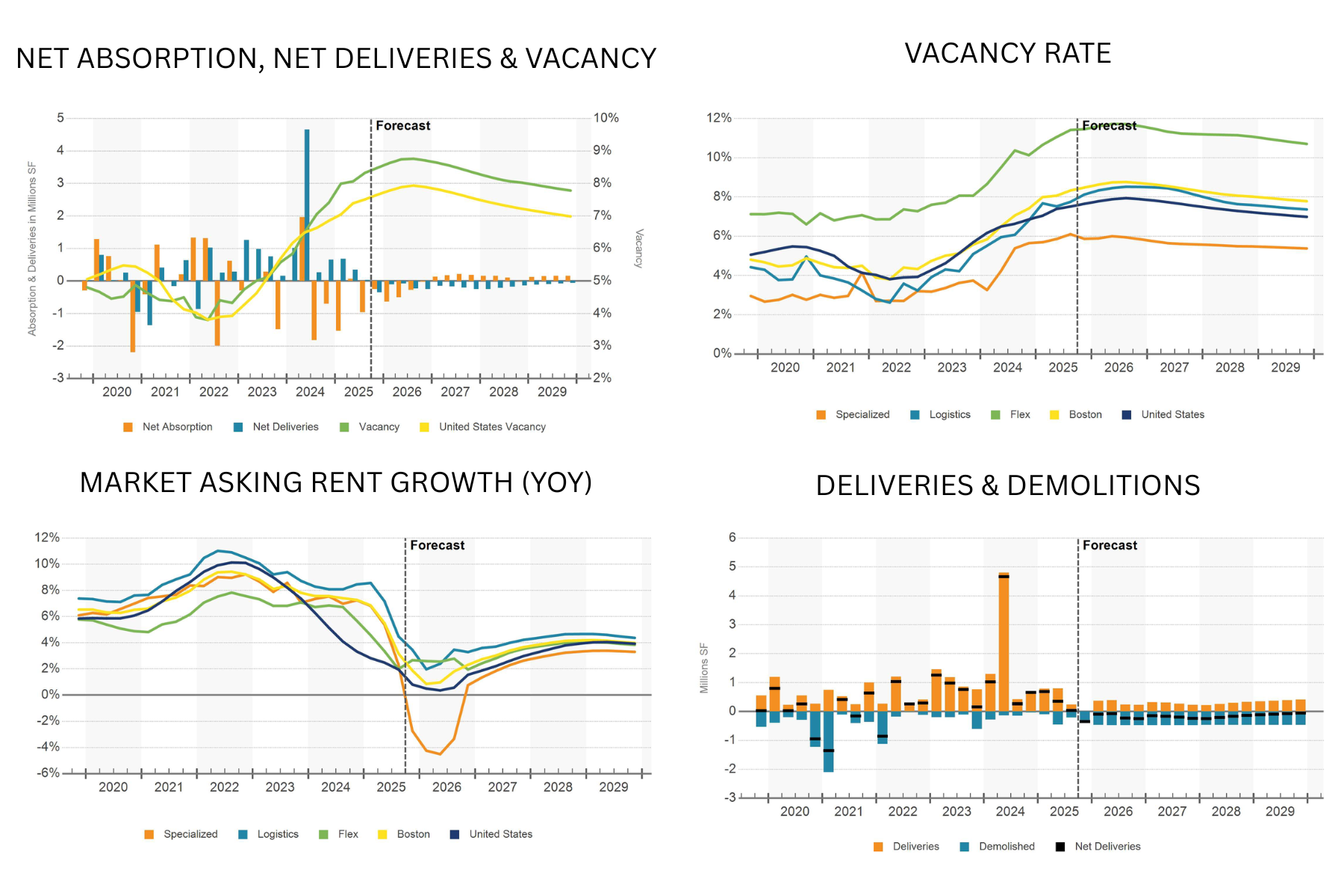

Boston’s industrial construction pipeline remains modest compared to national levels, with space underway totaling just 0.7 percent of inventory against the United States average of 1.6 percent. By the time the current development wave ends in midyear, Boston will have added a net 3 percent to its inventory over four years, far below the 10 percent expansion seen nationally. This restrained growth aligns with long term market patterns, as Boston’s industrial supply has historically evolved at a measured pace.

Demolitions have long played a role in shaping the region’s industrial landscape, with an average of roughly two million square feet removed annually and minimal new construction prior to the Great Recession. Between 2006 and 2020, these trends resulted in a net supply contraction of 15 million square feet. However, post pandemic conditions shifted the development trajectory, prompting builders to pursue speculative projects that aligned with surging demand for both e commerce fulfillment and traditional retail distribution.

Major occupiers such as Amazon and third party logistics providers absorbed several of these large scale speculative facilities in the suburbs. Additionally, flex space geared toward biotech R and D saw expansion as life science companies increased on shoring efforts following global supply chain disruptions. This surge culminated in nearly 7 million square feet of new supply delivered last year, the market’s highest annual total since 2001.

Today, 2.5 million square feet remains under construction, down significantly from the peak of 8.8 million square feet in late 2022 but still above historic norms. Much of the recent inventory growth has occurred in submarkets such as the I 95 Corridor South and Route 3 South, though results have been mixed. Several newly built warehouses in Wrentham and Plainville remain largely vacant, highlighting the disconnect between earlier demand expectations and current leasing conditions.

Elsewhere in the region, standout projects include Amazon’s massive 3.8 million square foot facility in North Andover and a 310,000 square foot flex R and D building in Lexington that is nearing completion but still unleased. As the market works through this supply wave, strategic positioning will be essential. Contact our team today to explore opportunities in this competitive market and position your business or portfolio for long term success.