Boston Area Multi-Family Market Report for Q3 2025

Overview

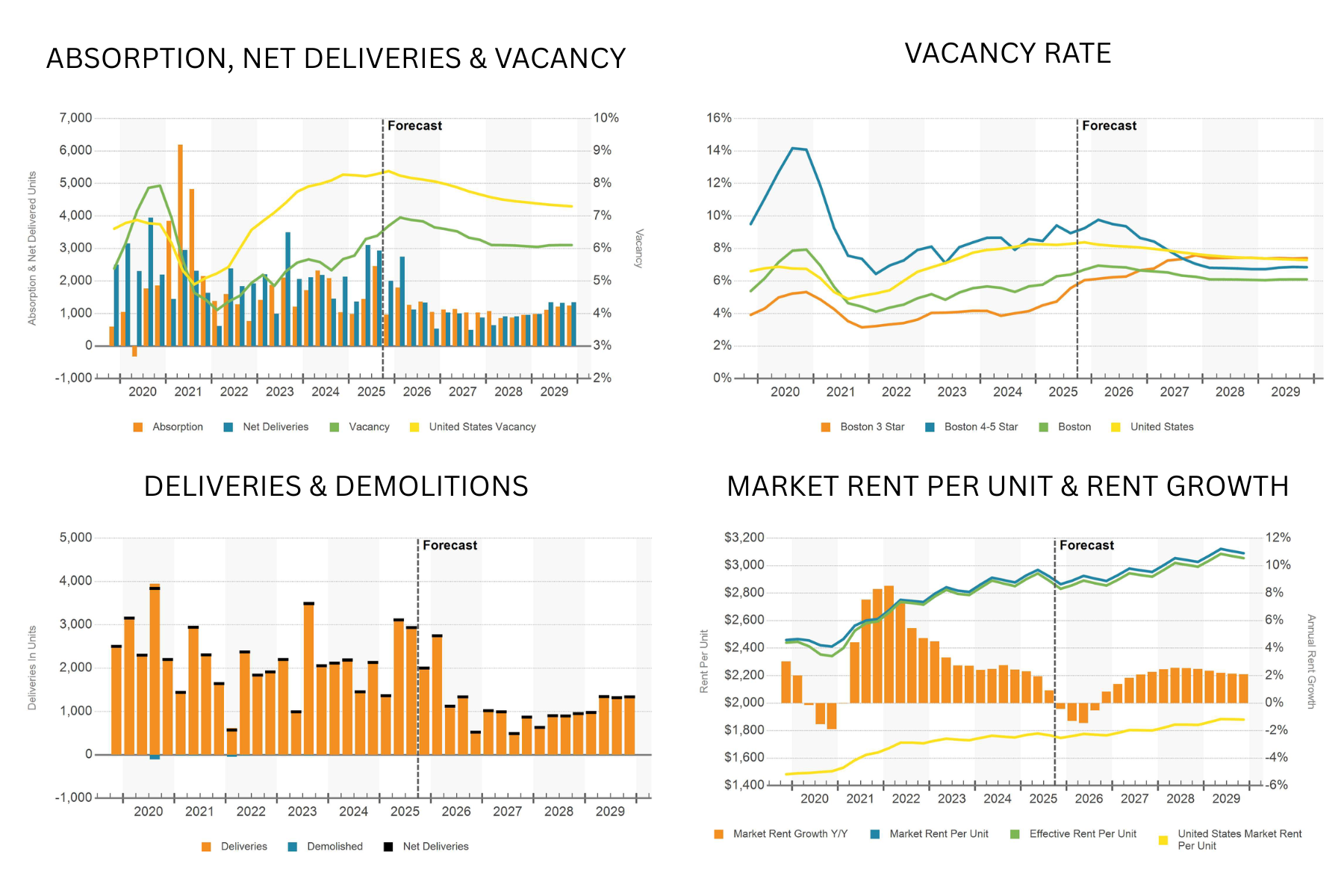

Boston’s multifamily market continues to show steady performance as stable leasing activity meets periods of elevated new supply. These delivery waves have placed modest upward pressure on vacancy and kept rent growth subdued. Even so, the market remains fundamentally healthy as construction levels begin to stabilize and demand holds firm across many key submarkets.

Vacancy currently sits at 6.5 percent, compared to the five year average of 5.5 percent. Over the past twelve months, the market recorded 6,000 units of net absorption against 9,600 units of net deliveries. Strong leasing has been concentrated in East Boston, Chelsea, Allston, and Brighton, where new construction has been most active. Suburban areas south of the city have also performed well, while some core neighborhoods such as Downtown Boston and parts of the northern suburbs have experienced softer demand.

After a stretch from early 2022 through late 2023 in which local demand could not keep up with the volume of units delivered, stronger leasing has helped close that gap. Boston continues to outperform national trends, especially when compared to Sun Belt markets where aggressive supply growth has pushed vacancies significantly higher. Boston’s vacancy rate now sits roughly 200 basis points below the national average and is expected to maintain this advantage even with continued new supply.

Rent growth has slowed sharply from the peak levels of 2022 and currently stands at 0.2 percent year over year. Although muted, growth is projected to strengthen later in the year and is already outpacing the national rate. This relative stability has supported ongoing investor confidence, helping the market maintain solid transaction activity despite broader economic uncertainty.

The base case forecast expects vacancy to edge slightly higher, though still remain below 7 percent, with rent growth staying above the 1 percent threshold by year end. While macro policy risks could weigh on job creation and slow leasing momentum, Boston remains a tier 1 market with durable long term appeal for both residents and investors. Contact our team today to discuss opportunities in Boston’s multifamily sector and how current trends may align with your investment strategy.