Boston Area Office Market Report for Q4 2022

Overview

As year three of the COVID-19 pandemic moves toward a reality, Boston’s office market remains on as solid a recovery path as you can find nationwide. Several key fundamental performance categories bear this out, and anecdotal evidence about tenant appetite increasing corroborates the statistical trends.

As if a starting gun went off in the spring, leasing activity took off in 21Q2 and did not slow down. Each quarter topped 4 million SF in total signed leases and despite the anchor of 20Q1 dragging it down the annual results from 2017 and 2018. A sub-16-million-SF leasing year still pales in comparison to loftier years last decade (19- 20 million SF was typical), but that range was unlikely given existing drags on demand.

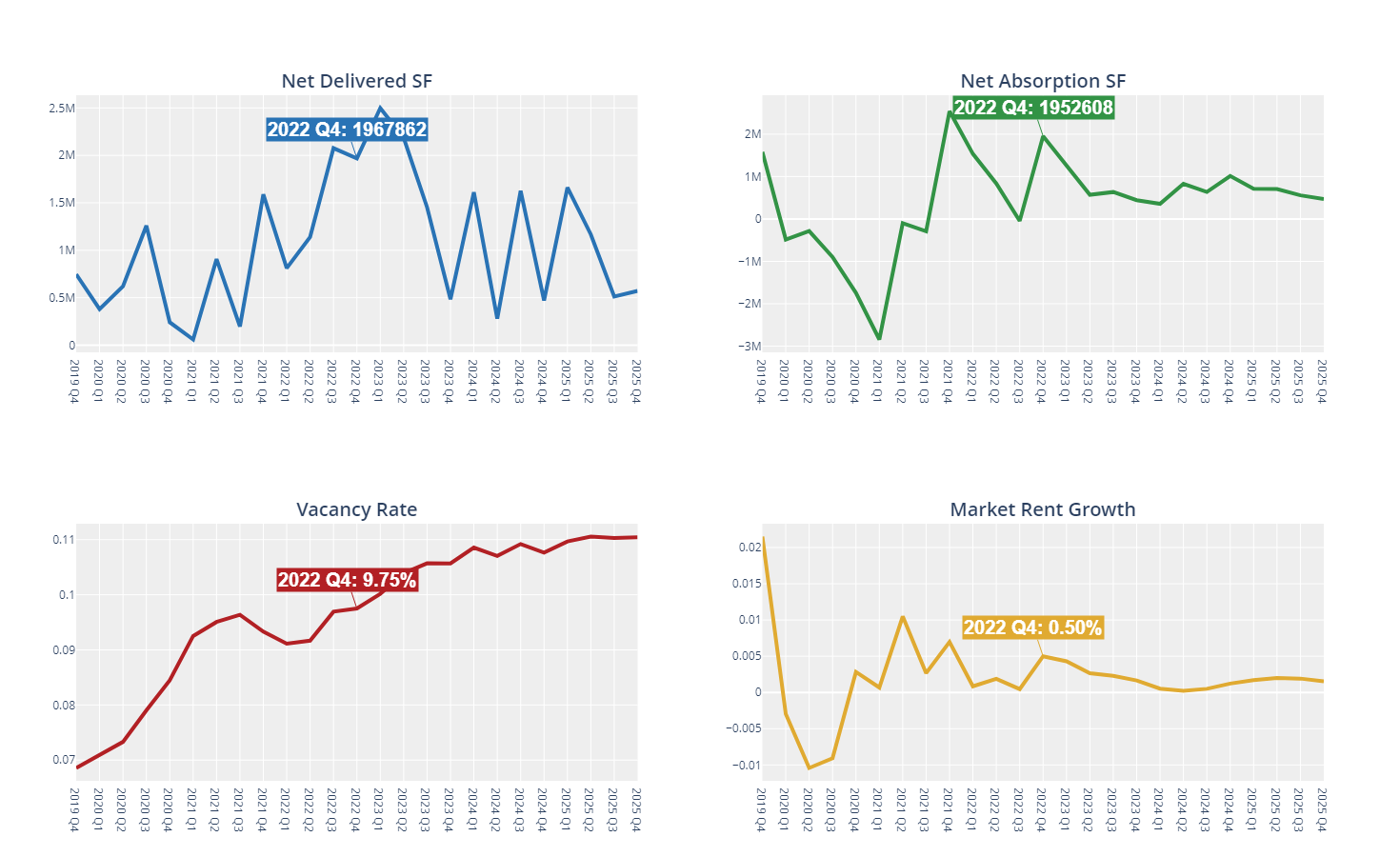

Vacancy across the metro, including tenant-owned buildings, might be approaching the upper end of its range. Even with several large deliveries slated for the next two to three years, Boston has several drivers in place to keep occupancy from sinking too much farther. The chase for lab space — or a reasonable facsimile, or even proximity to Boston’s unparalleled biotech ecosystem — has led to a stretching of the term in leasing and development circles. Beyond that, the metro area’s resilient economy and growing multifamily inventory have the population slowly but steadily growing. Law firms, tech-adjacent companies, and a diversifying finance sector are suitors for what is leftover, including significant space that remains unleased in the city’s Financial District.

Record-breaking investment in Boston’s office market speaks to the overarching bullish outlook here. Sales volume has a new benchmark now that $13 billion in office assets traded in 2021. Monopoly money is being thrown around at anything that is or can be converted to biotech, and thus the results can be taken with a grain of salt. But with no end in sight to the lab office gold rush, this may also be somewhat of a new normal.