Boston’s retail sector remains one of the strongest in the country due to a powerful consumer base and a limited construction pipeline. While many national markets face economic uncertainty, Boston continues to benefit from high employment levels and rising household incomes. These factors have helped keep availability rates near record lows and have supported resilient demand from both local and global retailers.

Household income in Boston leads all major Northeast metros, which directly fuels higher spending power. Annual household expenditures exceed one hundred thousand dollars on average, which is thirty four percent above the United States urban average. Although some of this spending relates to the region’s high housing costs, Boston also sees exceptional spending in dining, apparel, and entertainment. This elevated consumer activity continues to strengthen local retail performance and draws new entrants to the market.

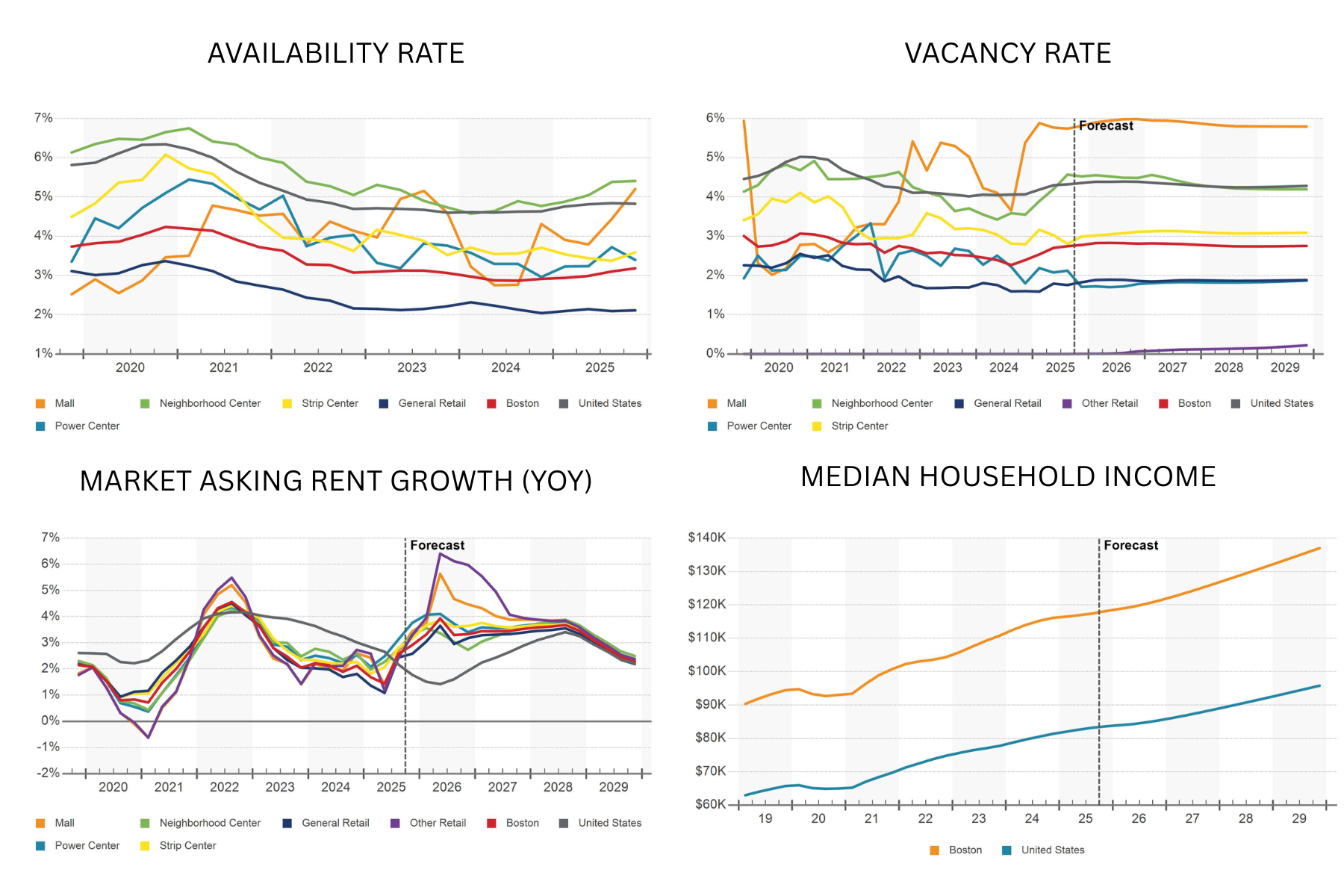

Even with strong demand, retailers face limited opportunities for expansion. Availability sits at just 3.2 percent, well below the national level of 4.8 percent, and ranks among the lowest of the fifty largest United States retail markets. New supply has not kept pace with demand, as the current construction pipeline represents only 0.3 percent of total inventory. Although construction starts have increased slightly over the past year, they remain far below historic peaks and are unlikely to shift market conditions in a meaningful way.

Looking ahead, the overall economic picture remains cautiously optimistic. Household income growth has surpassed inflation over the past four years, and vacancies are expected to stay between 2.5 percent and 3 percent as limited supply meets reduced move out activity. With this combination, rent growth is expected to remain steady, although the downside risks are becoming more pronounced.

Those risks include slower employment growth, pressure from tariffs, and potential impacts on population trends. Any of these factors could reduce consumer spending and delay expansion plans for retailers, even in a tight supply environment. Contact our team today to explore opportunities in this competitive market and position your business or portfolio for long term success.