Boston Area Retail Market Report for Q4

Overview

Test Much like its office and multifamily sectors, Boston’s retail market turned the corner faster than most in terms of 2021 recovery. While the outlook is clouded by the obvious pandemic overhang, signals keep emerging in 2022 that Boston has most of the retail ecosystem’s confidence.

Total retail space leased just topped 3 million SF last year, about 20% off of 2019’s record-setting year but leaving 2020’s down year (1.8 million SF) far behind. With this rebound, leased space has now topped 3 million SF in eight of the past nine years. Prior to 2013, that mark was hit just once (2003) in the preceding 15 years.

Tenants wanted into the market, but so did investors. Total sales volume reached $2.6 billion, shattering the previous record amount verified by CoStar researchers in 2019 ($1.4 billion). The deal flow speaks to the longterm bullishness across Boston, but submarket-specific storylines are also developing. Affordability and gentrification plays in areas like Revere, Watertown, and other near-in suburban areas point to future investment outside the mainstays.

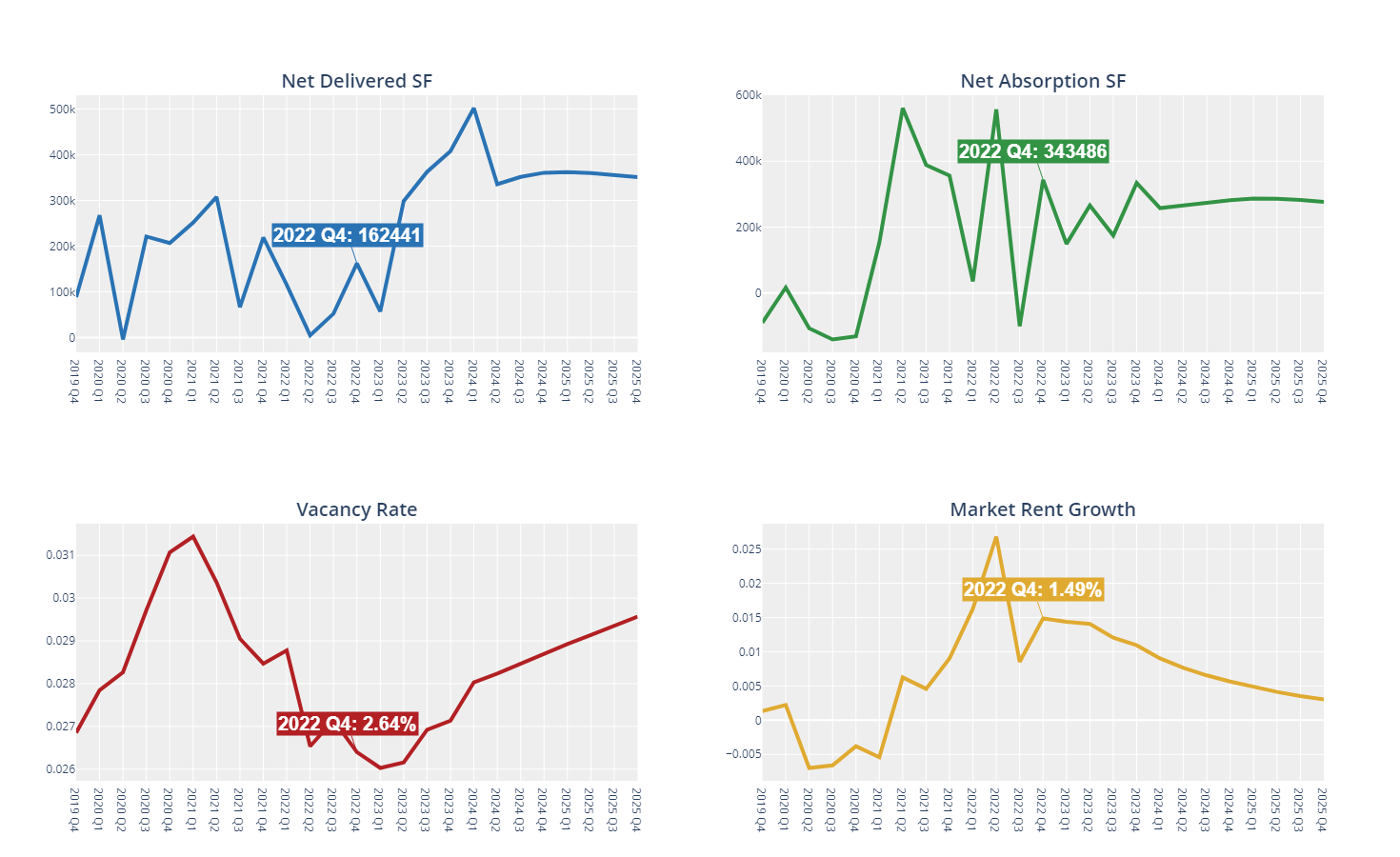

Some part of that optimism is a retail landscape thatbkeeps growing at one of the more cautious paces among larger metro areas. Construction starts remained below 1 million SF for the second year in a row in 2021, and new construction hasn’t topped 2 million SF since 2016.

CoStar shows asking rents at a macro level, and for most subtypes, they remain slightly below pre-pandemic levels and will need time to fully recover. Average posted rents entered 2020 at $25.00/SF, and annualized rent growth stands near 0.2% today.