Source: Milwaukee Business Journal

By Shawn Swenson

After multiple years of declining capital flows, could 2026 mark a comeback for commercial real estate (“CRE”) funding? A report by Cushman & Wakefield* provided an interesting summary of private CRE fundraising. While fundraising topped $160 billion in 2021 and 2022, that number decreased significantly in 2023 and was below $100 billion in 2024. The latter part of 2025 showed signs of increased fundraising, which is a welcome sign for all in the industry. More capital flowing to CRE can create more competition and higher asset prices. While the news of higher capital flows is great for owners, why now?

A likely answer is interest rates. Given that most CRE projects are leveraged, lower interest rates lead to lower overall interest costs resulting in more money to the bottom line and higher project returns. Higher returns are enticing to investors and can motivate them to invest.

The opposite is also true. Warren Buffet was credited with saying “Interest rates are to asset prices what gravity is to the apple”. When interest rates rose in 2023 and continued at an elevated level through 2025, they negatively impacted CRE returns. The exact amount varied based on factors such as location and property type, but it would be difficult to find any CRE owner or developer who BENEFITED from higher interest rates.

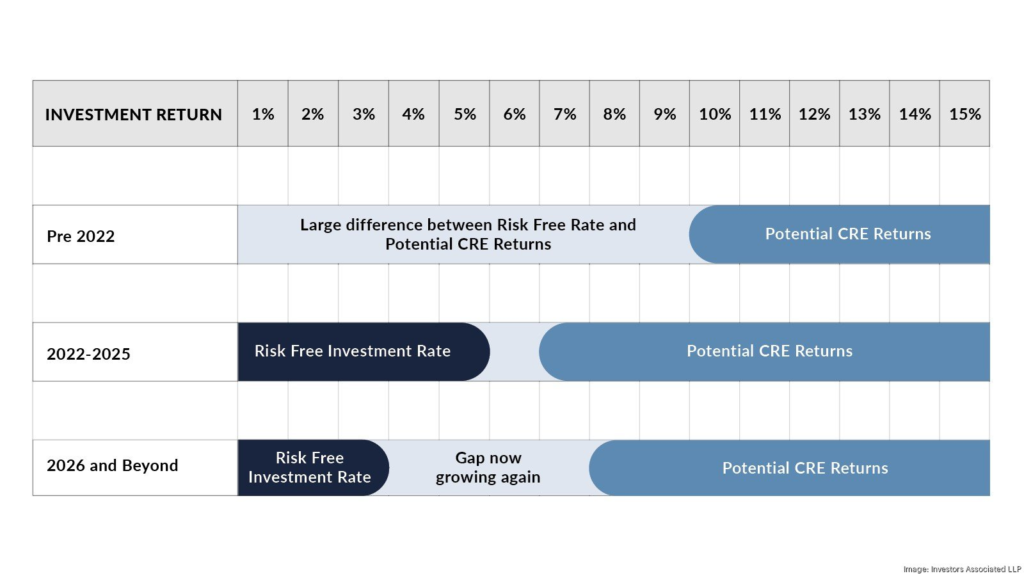

Higher interest rates did offer investors a new option that also pulled capital AWAY from CRE. Consider the difference between a risk-free rate (money market accounts, short term US Treasuries, etc.) and a typical CRE return. Pre 2023, the risk-free return was ZERO and a typical CRE return was in the 10-20% range (depending on the risk parameters of the fund or project development). The difference between the two investment options was a minimum of 10%. However, in 2024, the risk-free return was over 5% and CRE returns largely decreased, as higher rates weighed on returns. The difference between the two investment options at that point was very small and in many cases was no more than 1-2%. Given the small difference between a risk-free investment and a riskier investment, there was a lack of motivation to act. The returns offered by a riskier investment, in many cases, was simply not worth chasing.

Investors Associated LLP

Now, that math is changing once again. The risk-free rate is closer to 3.5% and CRE returns are already starting to benefit from lower interest rates. Many prognosticators are expecting short term rates to continue to decrease, and some expect a more dramatic decrease when Fed Chair Powell’s term ends in May. The gap between the risk-free rate and CRE returns is increasing again (to CRE’s benefit) and the wider it becomes, the more capital will likely flow to CRE.