Source: Principal Financial Group

By Rich Hill

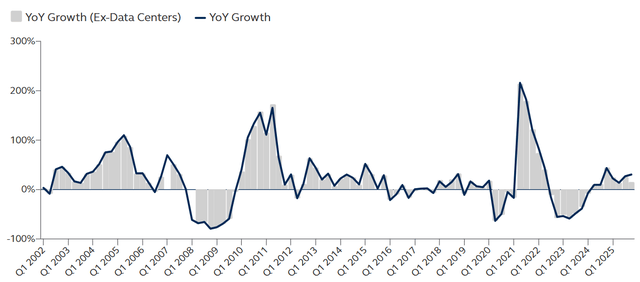

U.S. commercial real estate (CRE) transaction volumes rose 12% in December 2025 ($71.4bn) compared to the same month last year. Fourth quarter volumes reached $185.8bn, up 30% versus last year, while full year 2025 transactions increased 23% to $545.3bn. This marks the second consecutive year of rising deal activity (after 14% growth in 2024), pointing to a continued thaw in market liquidity after the prior downturn.

Reported volumes were meaningfully boosted by a sizable forward sale (~$23bn) of a data center under construction. Importantly, even excluding data centers in both 2025 and 2024, investment volumes still rose 14% in 4Q and 19% for the full year. This reflects a broad-based rebound in deal activity across every major traditional property type:

| Property | 4Q25 | 2025 |

|---|---|---|

| All | 30% | 23% |

| All (Ex-Data Centers) | 14% | 19% |

| Office | 23% | 26% |

| Industrial | 3% | 15% |

| Retail | 31% | 26% |

| Apartment | 4% | 9% |

| Hotel | 57% | 13% |

| Land | 25% | 44% |

| Senior Housing | 22% | 47% |

| Data Centers | 542% | 274% |

Source: MSCI, Real Capital Analytics, Principal Real Estate. Data as of 4Q 2025.

Bottom line

Transaction volumes are a useful barometer of market sentiment: accelerating activity typically reflects rising demand and confidence, while decelerating volumes point to growing caution. The market continues to face meaningful risks and uncertainties, but the recent pickup in transaction activity, reminiscent of the post-GFC recovery, is notable. It suggests the market may be reaching a similar inflection point, marked by returning confidence and renewed investor engagement.

CRE transaction volume

2022–present

This backdrop is consistent with the 2026 Global CRE Outlook: A Cycle for Selectivity, which argues that commercial real estate has entered a recovery phase by most traditional measures. However, returns are diverging sharply across sectors, regions, and fund strategies. This unevenness isn’t a flaw in the cycle—it is the cycle. Investors are no longer confronting a broad-based downturn; they are navigating widening dispersion. As the cycle ahead will likely be alpha-driven, real estate investors will need to take a page from equity investors’ playbook: asset and market selection will drive performance.