But as venture outlays fall, a recent spurt of layoffs has clouded outlook

By Robert Weisman Globe Staff

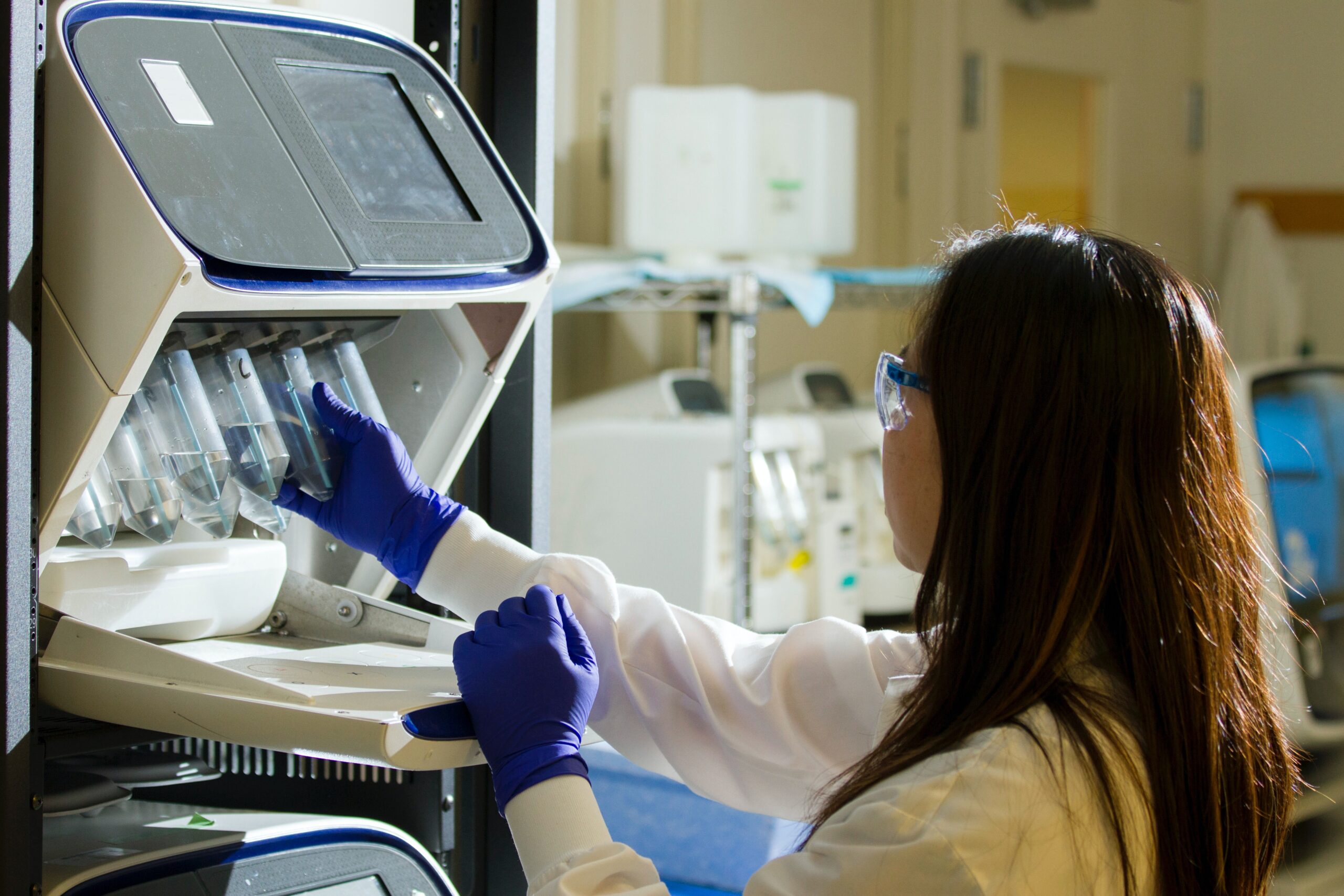

Massachusetts continued to expand its biopharma workforce in research labs and manufacturing plantslast year even as venture capital investment dwindled and fewer biotech companies went public.

Overall employment in the sector — a bellwether of the state’s innovation economy — increased 6.9 percent to about 114,000 in 2022, compared to nearly 107,000 the prior year, according tothe 2023 Industry Snapshot released Wednesday by the trade group MassBIO.

Biopharma growth slowed from the peak years of 2020 and 2021, when the COVID pandemic spurred record public and private investment in vaccines and treatments. But the sector continues to expand at a solid pace, MassBIO chief executive Kendalle Burlin O’Connell said.

“We’re continuing to see the outsize role that Massachusetts [plays] on the national and international life sciences landscape,” O’Connell said, pointing to a growth in research employment that last year outpaced that of California, a rival biopharma cluster.

Most of the top global drug makers have a research presence in Massachusetts. Japanese pharma giant Takeda was the top industry employer in the state last year, with 6,290 jobs, followed by French-based Sanofi, which employed 4,600 workers here.

Moderna, the Cambridge biotech that vaulted to prominence in 2020 with its COVID vaccine, leapfrogged Biogen of Cambridge and Vertex of Boston to become the top Massachusetts-based biopharma employer, with nearly 4,200 workers. Moderna ranked third on the overall list.

Jobs in research and development, the engine of the Massachusetts biopharma sector, grew 8.5 percent to about 64,000 in 2022, the MassBIO report said. Employment in biomanufacturing — an important new focus of the industry and state officials — climbed 6.3 percent to about 10,500.

Those gains came despite a 36.1 percent drop in venture capital investment — a key funding source for early-stage biotechs — to $8.7 billionfrom $13.6 billion in 2021, the highest level of the past decade.

The slower pace of venture funding has continued into this year, depriving many startups of the money needed to fund research and clinical trials. For the first six months of 2023, venture capital flowing to Massachusetts-based biopharma companies fell 27 percent to $3.7 billion from $5.1 billion in the first half of 2022.

Because job totals were reported as of last Dec. 31, the MassBIO snapshot doesn’t capture a wave of layoffs that has engulfed the state’s biopharma sector in 2023.

Over the summer, biotechs Karyopharm in Newton, Celsius Therapeutics in Cambridge, Homology Medicines in Bedford, Intergalactic Therapeutics in Cambridge, ImmuneID in Boston, and Infinity Pharmaceuticals in Cambridge, announced cutbacks, idling hundreds of workers in the state. Biogen, long an industry anchor, disclosed it was eliminating about 1,000 jobs worldwide, though it wasn’t clear how many of those cuts would be in Massachusetts.

Last week saw two large rounds of layoffs. Sage Therapeutics of Cambridge said it would eliminate 275 jobs, while Waltham’s Apellis Pharmaceuticals said it would pare 225 from its payroll.

Other companies in the sector, however, continue to hire, with job openings increasing every month since March, according to MassBIO. Data from the commercial real estate company JLL showed about 17,770 biopharma job postings in Massachusetts this year, suggesting the new jobs could be offsetting layoffs.

“There’s always been an environment where some companies succeed, but it’s hard,” O’Connell said, citing the risky nature of the research biotechs conduct in pursuit of breakthrough therapies. “Ninety percent of biotech companies fail. The unfortunate reality of layoffs and some companies closing has always been part of the cycle.”

The tight market for initial public offerings, which enable biotechs to raise money in the stockmarkets, has also proved a drag on the industry. Only eight Massachusetts biotechs went public last year, down from 25 in 2021. No biotechs went public in the first half of this year.

But the IPO window may be opening a crack. Last month, Apogee Therapeutics of Waltham filed to be listed on the Nasdaq exchange, saying it was seeking to raise $250 million.

O’Connell said the growth of biomanufacturing — the production of prescription medicines, especially cutting-edge therapies developed locally — is another bright spot for the industry. New plants are opening in Suffolk County, Worcester County, and other locations, enabling the industry to recruit blue-collar workers as it expands beyond Middlesex County, where Cambridge is located.

“We want to create new on-ramps into these high-paying jobs,” she said.

The average annual wage in the state’s biopharma sector was just over $191,000, according to the MassBIO report, up about $30,000 since 2018. That figure, however, is skewed by the lucrative pay packages of high-priced executives at biopharma companies.