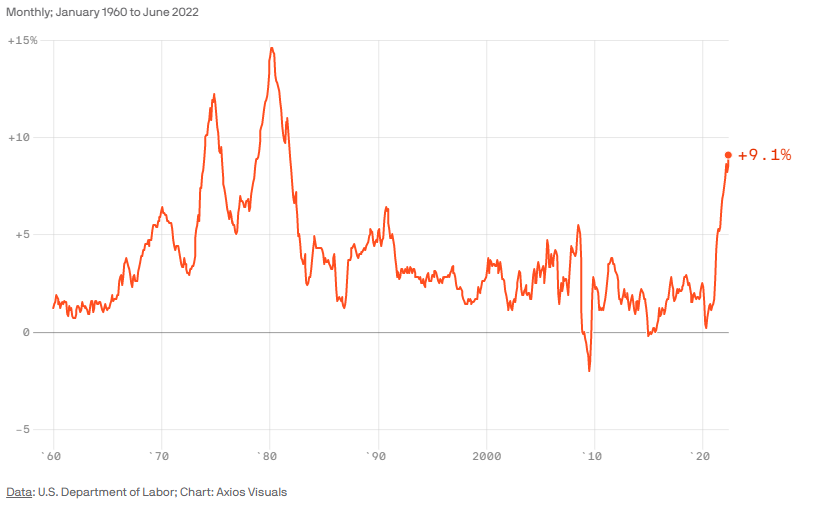

Consumer Price Index, year-over-year percentage change

By Courtenay Brown via Axios

Inflation soared to a fresh four-decade high in June, as prices rose 9.1% from last year — 1.3% from the prior month — the government said on Wednesday.

Why it matters: The price shock is tanking Americans’ view of the economy — and risks pushing the Federal Reserve into moving aggressively to cool inflation, possibly triggering a recession.

The big picture: The Consumer Price Index only covers June, so the recent drop in commodity prices isn’t reflected in the report.

- Stripping out those volatile food and energy costs, prices jumped 0.7%, a tick higher than the prior month.

- This so-called “core” index is 5.9% higher than a year ago.

Details: The largest contributors to inflation were shelter, used cars and trucks, new cars and motor vehicle insurance.

The backdrop: The Fed has undertaken the most aggressive interest rate hike campaign in decades to chill the economy, which in effect, should slow price growth. Officials say the moves won’t necessarily tip the economy into a recession — but they admit it’s a possibility.

- They also note there are factors out of its control that may complicate its plan, namely Russia’s invasion of Ukraine and supply chain snarls — both of which have limited supply of key goods, fueling the supply-demand mismatch that’s pushed up prices.

- Meanwhile, the Biden administration is searching for ways to soothe voters’ discontent as inflation cuts into wage gains and weighs on Americans’ wallets. Consumer sentiment is at an all-time low.

What they’re saying: “While today’s headline inflation reading is unacceptably high, it is also out-of-date,” President Biden said in a statement.

- “Today’s data does not reflect the full impact of nearly 30 days of decreases in gas prices, that have reduced the price at the pump by about 40 cents since mid-June,” he added.

The bottom line: Inflation is rising at the fastest rate since 1981.